We Work With Companies You Can Trust

Over 50+ Top A-Rated Insurance

Compare prices among the nation’s most trusted insurers.

We work with Companies you can Trust

Get a Customized Retirement Plan Tailored to Your Needs

Complete the short survey below to receive a personalized quote from Us.

What is Retirement Planning?

Retirement planning is the process of assessing one's current financial situation, estimating future expenses and income, and developing a strategy to achieve financial security and maintain one's standard of living during retirement. It includes budgeting and forecasting, investing in retirement savings accounts and plans, such as 401(k)s and IRAs, and consulting with a Licensed Advisor.

Security is a priority

How it Works

Answer Questions

We’ll ask you some questions about yourself and the insurance coverage you want.

Compare Rates

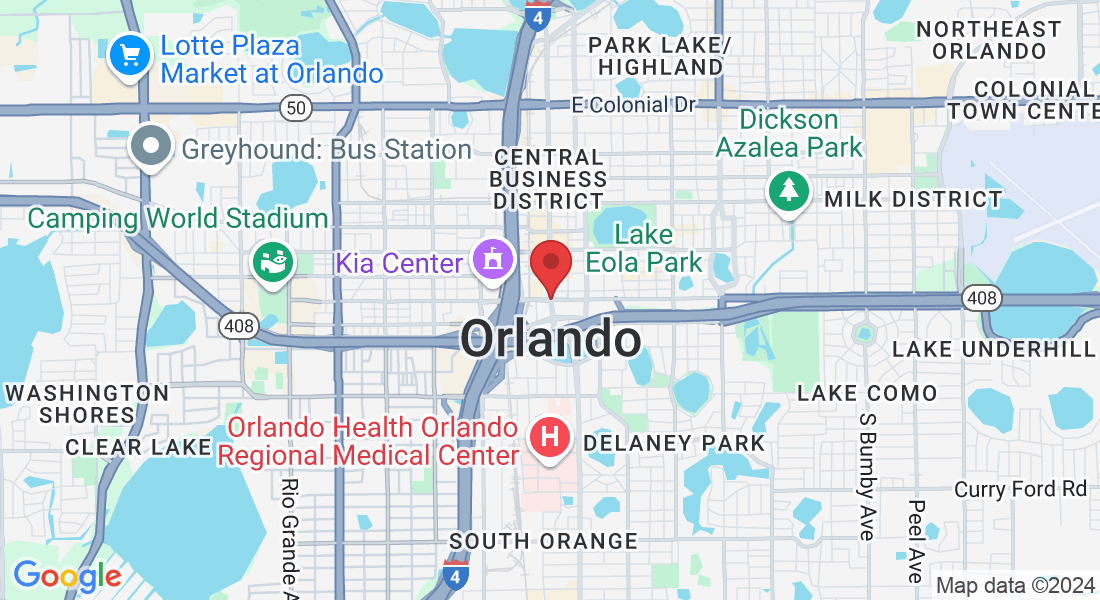

We’ll sort through over 50 insurance carriers and find the best rates available in your area. We’ll even check for discounts.

Find Coverage

Review the offers and find the coverage that is right for you. The best part is that it’s 100% free and only takes a few minutes.

What is Mortgage Protection?

Mortgage protection insurance is a type of life insurance policy that is designed to pay off a person's mortgage in the event of their death. The policy provides a death benefit to the policy's beneficiaries, which can be used to pay off the outstanding balance on the mortgage.

Here are a few of the benefits of Mortgage Protection

It provides financial protection to the policyholder's loved ones

If the policyholder dies, the death benefit from the mortgage protection insurance policy can be used to pay off the outstanding balance on the mortgage. This can provide financial protection to the policyholder's loved ones, ensuring that they are not left with a large mortgage debt to pay off.

It can help protect the policyholder's investment in their home

A mortgage is typically a person's largest financial investment, and losing the home to foreclosure due to an unexpected death can be financially devastating. Mortgage protection insurance can help protect the policyholder's investment in their home, ensuring that their loved ones can continue to live in the home even if the policyholder dies.

It can provide peace of mind

Purchasing mortgage protection insurance can provide peace of mind, knowing that your loved ones will be financially protected in the event of your death. It can help you feel confident that your loved ones will be able to maintain their standard of living and continue to live in your home, even if you are no longer there to provide for them.

It is typically less expensive than other types of life insurance

Because mortgage protection insurance is specifically designed to provide financial protection for a person's mortgage, it is typically less expensive than other types of life insurance. This can make it more affordable for many people to purchase this type of coverage.

Things to Consider:

Steps to consider when planning for retirement.

Assess your current financial situation: Determine your current income, expenses, savings, and debts to get a clear picture of your current financial situation.

Estimate your future expenses: Estimate how much you will need to cover your expenses in retirement, taking into account factors such as inflation and health care costs.

Determine your retirement income sources: Identify all the sources of retirement income you may have, such as Social Security, pensions, and investments.

Create a retirement budget: Based on your estimated expenses and expected income, create a budget for your retirement years.

Invest in retirement savings accounts: Consider investing in tax-advantaged retirement savings accounts, such as 401(k)s and IRAs, to help you save for retirement.

Review and adjust your plan: Review your plan periodically and adjust it as necessary to reflect changes in your financial situation or goals.

Consider professional advice: Consult with a financial advisor or retirement planner to help you create a comprehensive retirement plan.

Take action: Start saving and investing as soon as possible to give your money the most time to grow and work for you.

Make sure you have a plan for unexpected events: Make sure you have a plan for unexpected events, such as long-term care or unexpected health expenses.

Review your estate plan: Review and update your estate plan, to ensure that your assets will be distributed according to your wishes when you pass away.

How much do I need for Retirement?

The amount of money you will need for retirement depends on several factors, including your lifestyle, health care expenses, and the age at which you plan to retire. A commonly used rule of thumb is the "80% rule," which suggests that you will need 80% of your pre-retirement income to maintain your standard of living in retirement. However, this can vary greatly depending on individual circumstances.

It is important to do your own research and calculations to determine how much you will need for retirement. You can use retirement calculators available online to get an estimate of how much you will need to save based on your current income, expenses, and retirement goals. You can also consult with a financial advisor to help you create a personalized retirement plan and determine how much you will need to save.

It is important to remember that the earlier you start saving and planning, the more time your money has to grow and the less you will need to save each month. It is also important to consider unexpected expenses and events that could impact your retirement plan, such as long-term care or unexpected health expenses.

Types of plans that you can consider

Employer-sponsored plans: Many employers offer retirement savings plans, such as 401(k)s and pensions, which can be a convenient way to save for retirement. These plans often offer employer contributions and tax advantages.

Individual Retirement Accounts (IRAs): IRAs are a type of individual retirement savings plan that offer tax advantages. There are two main types of IRAs: Traditional and Roth. Traditional IRAs allow you to contribute pre-tax dollars and the growth is tax-deferred until you withdraw the money in retirement. Roth IRAs allow you to contribute post-tax dollars and the withdrawals in retirement are tax-free.

Annuities: Annuities are a type of investment that can provide a guaranteed stream of income in retirement. They can be a good option for people who want to ensure a steady source of income in retirement but require a long-term commitment.

Social Security: Social Security is a government-provided retirement income program. It is important to understand how Social Security works and when to start taking benefits.

Savings accounts: Saving money in a high-yield savings account or CD can also be a good way to build up a nest egg for retirement.

Real-estate investments: Some people consider investing in real estate as a way to generate income during retirement.

Long-term care insurance: Long-term care insurance can help cover the cost of long-term care expenses, such as nursing home care or in-home care.

It is important to consider your own personal goals and circumstances when choosing the right retirement plans. Consulting with a financial advisor can help you to create a personalized retirement plan that will work best for you.

Insurances for your

child's future

Get up $50,000 in Childrens Whole Life insurance

Contact Us

If you have any questions about the insurance process, please fill out this form and one of our experienced brokers will get back in touch with what's going on as quickly as possible.

Services

Life Insurance

Final Expense

Mortgage Protection

Retirement Planning

Links

© 2023 Family National Benefits - All Rights Reserved