We Work With Companies You Can Trust

Over 50+ Top A-Rated Insurance

Compare prices among the nation’s most trusted insurers.

Get a Personalized Final Expense Quote

Complete the short survey below to receive a personalized quote from Us.

What is Final Expense?

Final expense insurance is a type of life insurance policy that is designed to cover the costs associated with a person's funeral and other end-of-life expenses. These costs can include things like a casket, burial plot, funeral service, and other expenses that may arise.

Security is a priority

How it Works

Answer Questions

We’ll ask you some questions about yourself and the insurance coverage you want.

Compare Rates

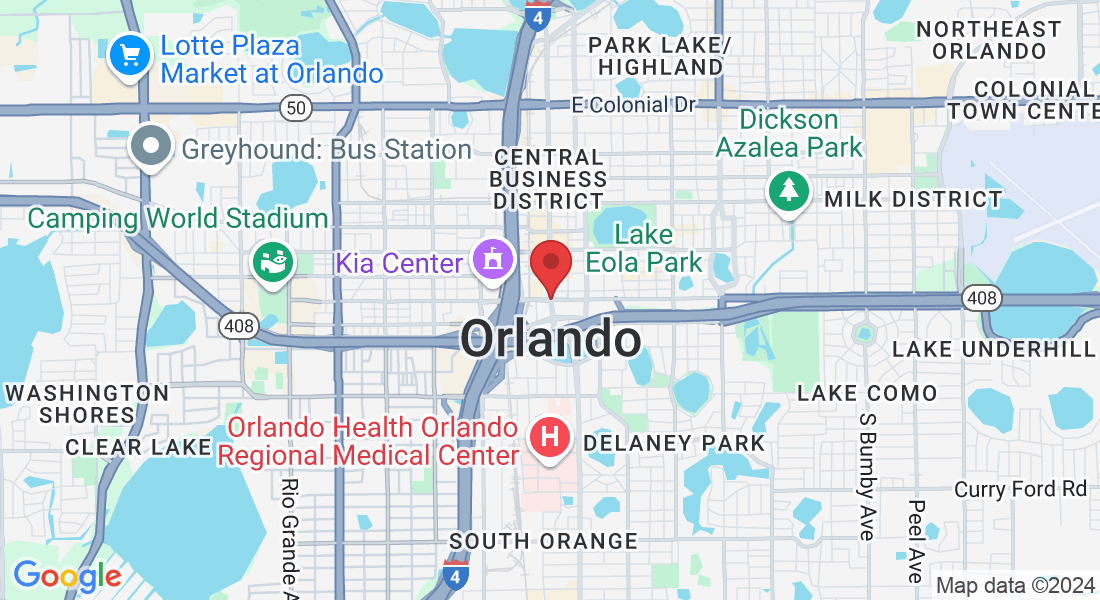

We’ll sort through over 50 insurance carriers and find the best rates available in your area. We’ll even check for discounts.

Find Coverage

Review the offers and find the coverage that is right for you. The best part is that it’s 100% free and only takes a few minutes.

Things worth considering:

Who should consider buying final expense insurance?

Anyone who wants to ensure that their loved ones are not burdened with the costs of their funeral and other end-of-life expenses may want to consider buying final expense insurance. This can provide peace of mind, knowing that these expenses will be taken care of even if you are not around to pay for them yourself.

How much does final expense insurance cost?

The cost of final expense insurance will vary depending on factors such as the policy's death benefit, the insurance company offering the policy, and the insured person's age and health. In general, final expense insurance is typically less expensive than other types of life insurance because the death benefit is smaller, and the policy is intended to cover specific, limited expenses.

Can I use final expense insurance to pay for expenses other than my funeral?

Yes, final expense insurance can be used to pay for other end-of-life expenses in addition to a person's funeral. These can include things like medical bills, outstanding debts, or other expenses that may arise. It is important to carefully review the terms of your policy to understand what expenses are covered.

How do I choose a final expense insurance policy?

When choosing a final expense insurance policy, it is important to carefully consider your needs and the options available to you. Here are some steps you can take to help you choose the right policy for you:

Determine how much coverage you need: Consider the costs associated with your funeral and other end-of-life expenses and determine how much coverage you need to ensure that these expenses are covered.

Shop around and compare policies: Compare different policies from different insurance companies to find the one that offers the right amount of coverage at a price you can afford.

Read the policy carefully: Carefully review the terms of the policy to make sure you understand what is covered and what is not. Pay particular attention to any exclusions or limitations that may apply.

Consider the insurance company's reputation: Choose a reputable insurance company with a good track record of paying claims and providing excellent customer service.

Ask questions: If you have any questions or concerns about a particular policy, don't be afraid to ask the insurance company for more information. It is important to fully understand the terms of the policy before you make a decision

Can I purchase final expense insurance if I have a pre-existing health condition?

Yes, it is possible to purchase final expense insurance if you have a pre-existing health condition. Because final expense insurance typically has a lower death benefit and is easier to qualify for than other types of life insurance, some insurance companies may be willing to offer a policy to individuals who have pre-existing health conditions. However, it is important to keep in mind that the terms of the policy may be different if you have a pre-existing condition, and the premium you pay may be higher. It is important to shop around and compare different policies from different insurance companies to find the one that best meets your needs.

Insurances for your

child's future

Get up $50,000 in Childrens Whole Life insurance

Contact Us

If you have any questions about the insurance process, please fill out this form and one of our experienced brokers will get back in touch with what's going on as quickly as possible.

Services

Life Insurance

Final Expense

Mortgage Protection

Retirement Planning

Links

© 2023 Family National Benefits - All Rights Reserved